Practical and proven strategies you can deploy today.Australia is experiencing unprecedented events, firstly following the bushfires and now through the increasing impact of the coronavirus.The impact of these events is likely to see Australia enter into recession for the first time in 29years.For businesses to prepare and combat the effect of a recession ,business owners must urgently assess and prepare for such an event. To assist business owners through these difficult times, below is a simple and practical approach that business owners can implement during such a crisis. .Here is our simple 5-step process to crisis proof your business.

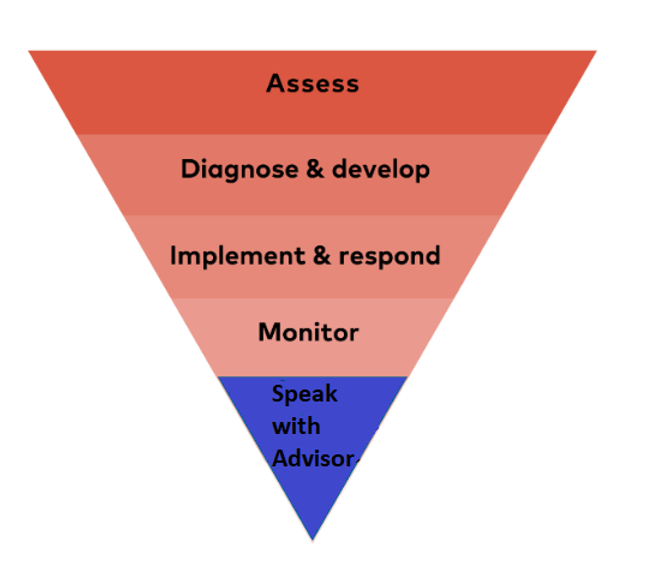

Crisis management framework

- assess

- diagnose and develop

- implement and respond

- monitor

- speak to us

1. Assess

The task is to focus on what is within your control and what your business key drivers are.

- Is the work environment for staff and customers safe?

- What business expenses are key to the business operating and which are not?

- Are there any business expenses that can be reduced without impacting the business’s long-term viability?

- Which revenue streams have been impacted?

- What initiatives can be undertaken to protect and maintain revenue?

- What obligations do you have to financial institutions through facilities?

- What statutory obligations exist?

2.Diagnose and develop

Once you have assessed the key drivers of your business then it is imperative to develop a plan. Documenting such a plan, allocating responsibilities, and setting agreed timelines is essential. Ensure your staff and key stakeholders are supportive of the plan.Communication is key.

Design a plan to ensure a safe environment for your staff and customers. How are you communicating that a safe environment exists?How often are you communicating?

- Optimise revenue—what revenue initiatives can be undertaken to maintain a sustainable level of income—consider collection of debtors, sale campaign, alternative delivery methods (online). Are there new revenue initiatives that can be undertaken as a result of changing market conditions?

- Supply lines—ask your suppliers if they can recommend alternative supply lines if they’re affected by imports. If they can’t, explore finding alternative lines of supply.

- Reduce expenses—a detailed review of business expenses should be undertaken to identify any expenses that can be reduced or even eliminated altogether. This could be a reduction in staffing hours, termination of unnecessary or non-essential services or even sale of surplus assets that are subject to finance.

- Deferral of expenses—are there any other expenses that can be postponed? Are there any creditors including suppliers and landlord that are willing and able to provide such support through relaxed payment terms? The Australian Taxation Office (ATO)can provide relief through the following initiatives:

- Deferring (by up to four months)the payment date of amounts due through the business activity statement—including pay as you go (PAYG) instalments)—income tax assessments, fringe benefits tax assessments and excise tax.

- Allowing businesses on a quarterly reporting cycle to opt into monthly GST reporting to get quicker access to GST refunds they may be entitled to.

- Allowing businesses to vary PAYG instalment amounts to zero for the March 2020 quarter. Those businesses can also claim a refund for any instalments made for the September 2019 and December 2019 quarters.

- Remitting any interest and penalties, incurred on or after 23January 2020, that have been applied to tax liabilities.

- Working with affected businesses to help them pay their existing and ongoing tax liabilities by allowing them to enter into low-interest payment plans.

- Financier support—contact your financier to discuss what financial support is available (usually by way of deferred payment terms under the loan facility).

- Consider government assistance—find out which government support applies to your circumstances.

3.Implement and respond

Urgently responding to these situations could include the following approach.

- Increase sales through new sales initiatives and innovative revenue avenues.

- Increase exposure through other platforms to sell and market your business. Could platforms previously determined irrelevant to the business now be relevant?Consider ecommerce platforms and social media platforms to increase your businesses visibility and exposure to current and new markets

- Communicate with stakeholders.Communication mus tbe open and transparent with employees, financial institutions, landlords, suppliers, the ATO, customers and local business networks. It should be regular and often.

- Implement relaxed payment terms. Make it easier for other businesses to do business with you.Be careful that you understand the financial impact it might have on your business.

- Enable staff to work from home if possible. Staff safety is paramount and non-negotiable. However, knowing what they need to be effective in their job away from an office or premises environment will help expedite this process and streamline job functions/tasks during this period

4.Monitor

Regularly check on the financial position. Step 4 means:

- Monitor on a regular basis.

- Adapt and amend your plan if necessary.

5.Speak to a business adviser

Whilst these times are unknown having someone with experience with difficult business decision and when to make them can be critical to business survival and coming out of a situation in the best way possible.