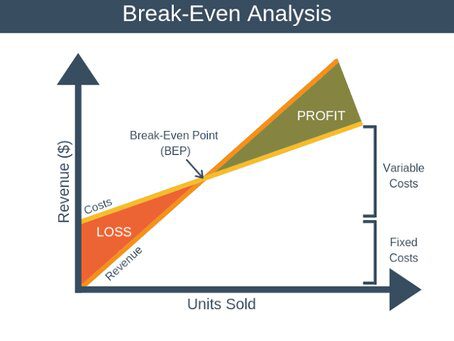

The break-even analysis calculates the point where your business has reached a zero balance i.e. when your income covers your expenses exactly. It’s a great tool for small business from starting up to getting a greater understanding of your long term business. One of the many benefits of completing a break-even point is it will highlight particula stress points in your fixed and variable costs and how they coralte with sales percentages.

Before you can calculate your break-even point, complete the following details:

Timeframe (e.g. monthly/yearly)Average price of each product/service soldAverage cost of each product/service to make/deliverFixed costs for the month/year.

Once you have your figures above, you can work out your break even by completing the calculations below:

Percentage of price that is profit – Calculate (Average price of each product/service sold minus Average cost of each product/service to make/deliver) divided by Average price of each product/service sold.

Number of units sold needed to break-even – Calculate Fixed costs for the month/year divided by (Average price of each product/service sold minus Average cost of each product/service to make/deliver).

Total sales needed to break-even – Calculate Number of units sold needed to break-even multiplied by Average price of each product/service sold.

Once you know your breakeven point you can work out different percentages and factor in certain profit markers such as required profit to owner to get a greater understanding of your business and help guide you towards a goal. The break even analysis is a great tool to help generate KPIs in business.

A good template can be found at:

https://templates.office.com/en-us/breakeven-cost-analysis-tm01116512

Powell Enterprises are small business accountants based in Wamberal on the central coast New South Wales that service between Sydney, Central Coast and Newcastle area. We cater to businesses from startup to under $50 million.