At the 2019-20 MYEFO, the underlying cash balance for 2020-21 was forecast to be a surplus of $6.1 billion (0.3 per cent of GDP). Since then, the Government has responded decisively to the 2019-20 bushfires and COVID-19 pandemic.

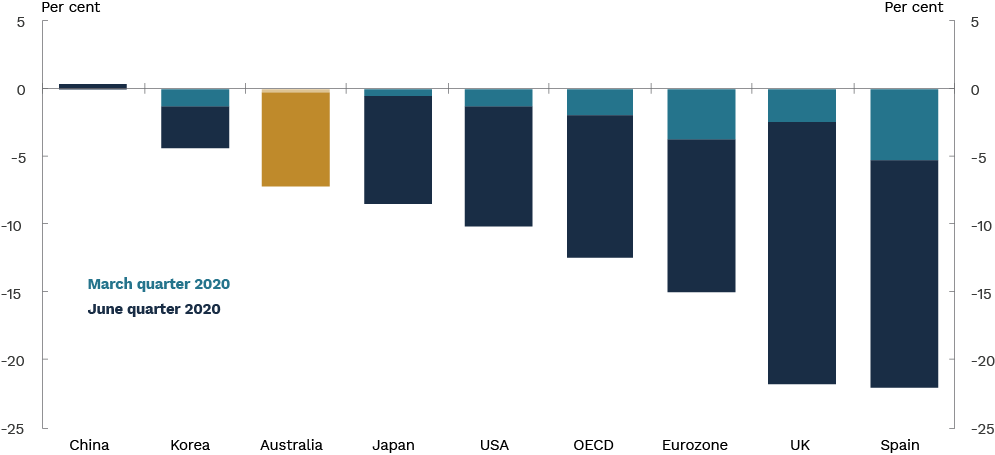

Because of an unprecedented amount of difficulty in the Australian and global economy we will obviously see a very different and accelerated budget this year which will focus on building back the economy quickly through tax cuts and investment in local Australian businesses. We are in our first recession in Australia in 30 years so this budget is critical to enable Australia to restart and continue the impressive impact we have on the global economy.

Revised Fiscal Strategy

Almost $50 billion in tax relief for businesses and low-and-middle-income earners is at the heart of $98 billion in new measures designed to return the economy to health and create 950,000 jobs over the next four years.

Infrastructure investment

Since the start of the COVID-19 pandemic the Government has committed to invest an additional $14 billion in new and accelerated infrastructure projects over the next four years. These projects will support a further 40,000 jobs during their construction.

This investment is part of the Government’s record 10-year transport infrastructure investment pipeline, which has been expanded to $110 billion and is already supporting 100,000 jobs on worksites across the country.

Instant Asset Write-off

Making good on the Prime Minister’s pledge for a business-led-recovery, Tuesday’s federal budget contained an investment allowance which, at a cost of $26.7 billion in just over two years, will enable almost every company in the Australia to immediately write off in full any eligible depreciable asset, with no limit on value.

I would imagine a good business strategy will include a capital asset acquisition strategy along with low interest rates to capitalize on the current economic environment.

In order to turbocharge investment, the measure came into effect at 7.30pm on Tuesday night and will apply to eligible assets used or installed by June 30, 2022. Assets which can be written off are the same as those deemed eligible under the current depreciation schedule and do not include buildings.

Write off of carryback provisions

The budget also included $4.9 billion in loss carryback provisions which will enable the same businesses – those with turnovers of up to $5 billion – to write off any losses incurred until June 2022 against profits made on or after 2018-19, before the coronavirus pandemic struck.

The Government will also allow companies with turnover up to $5 billion to offset losses against previous profits on which tax has been paid, to generate a refund.

Supporting housing construction

As part of our economic recovery plan to create jobs, rebuild our economy and secure Australia’s future, an additional 10,000 first home buyers will be able to purchase a new home sooner under the extension to the First Home Loan Deposit Scheme.

The additional 10,000 places will be provided in 2020-21 to support the purchase of a new home or a newly built home. This will allow first home buyers to secure a loan to build a new home or purchase a newly built dwelling with a deposit of as little as 5 per cent, with the Government guaranteeing up to 15 per cent of a loan.

Tax cuts

The cost to the budget of bringing the cuts forward from their legislated start date of July 1, 2022, and tweaking them, will be $17.8 billion.

Treasurer Josh Frydenberg said the so-called stage two tax cuts, which will lift the income threshold at which the 37 per cent tax rate applies to $120,000, would be brought forward by two years to July.

The stage two tax cuts will lift the income threshold at which the 37 per cent tax rate applies from $90,000 to $120,000.

“As they spend their tax cuts this will help local businesses to keep their doors open and hire more staff. This will reward effort and create jobs,” he said.

They will also make permanent the Low and Middle Income Tax Offset (LMITO) by lifting from $41,000 to $45,000 the income threshold under which the 19 per cent tax rate applies.

But the tweak involves both making this change and giving the same people the LMITO for another year, which is worth a $1080 rebate at the end of this financial year. Treasury forecasts the tax cuts to create 40,000 jobs.

But the government did not bring forward its controversial stage three tax package, which abolishes the 37 per cent rate and applies a flat rate of 30 per cent to all income between $45,000 and $200,000.

Wage subsidy

At a cost of $4 billion, employers who hire an unemployed person will receive a $200 weekly wage subsidy if that person is aged between 16 and 29, and $100 if the person is aged 30 to 35.

“These tax cuts are estimated to increase GDP by $3.5 billion in 2020-21 and $9 billion in 2021-22, while creating an additional 50,000 jobs by the end of 2021-22,” the budget papers say.

“It’s all about jobs. It’s all about helping those who are out of work get into work and those who are in a job, stay in a job,” Mr Frydenberg said.

The JobMaker Hiring Credit is estimated to support around 450,000 positions for young people and cost $4 billion from 2020-21 to 2022‑23.

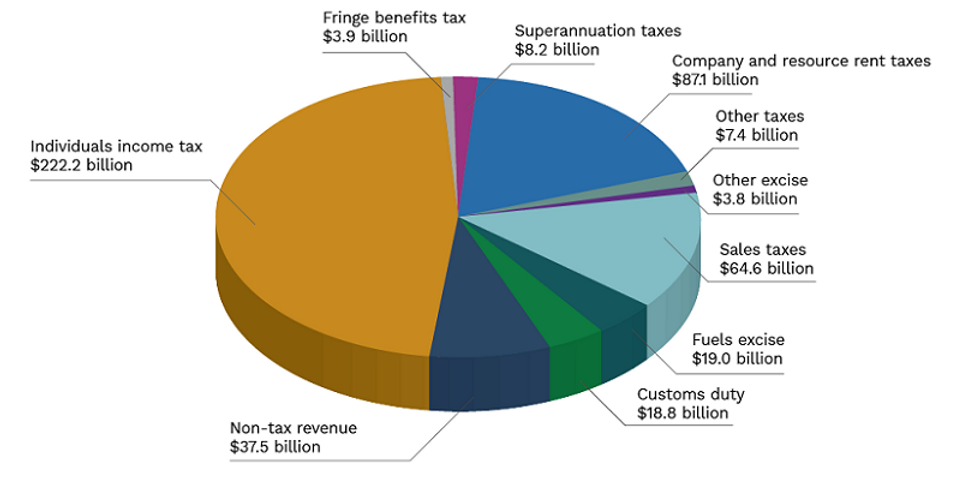

Where revenue comes from (2020-21)

Where taxpayers’ money is spent (2020-21)